Chronological Order

Magelssen, Catherine, Luis Ballesteros, and Casidhe Troyer. 2025. “Connectivity Infrastructure and Innovation: The Effects of Headquarters versus Subsidiary Management”. Forthcoming at Research Policy .

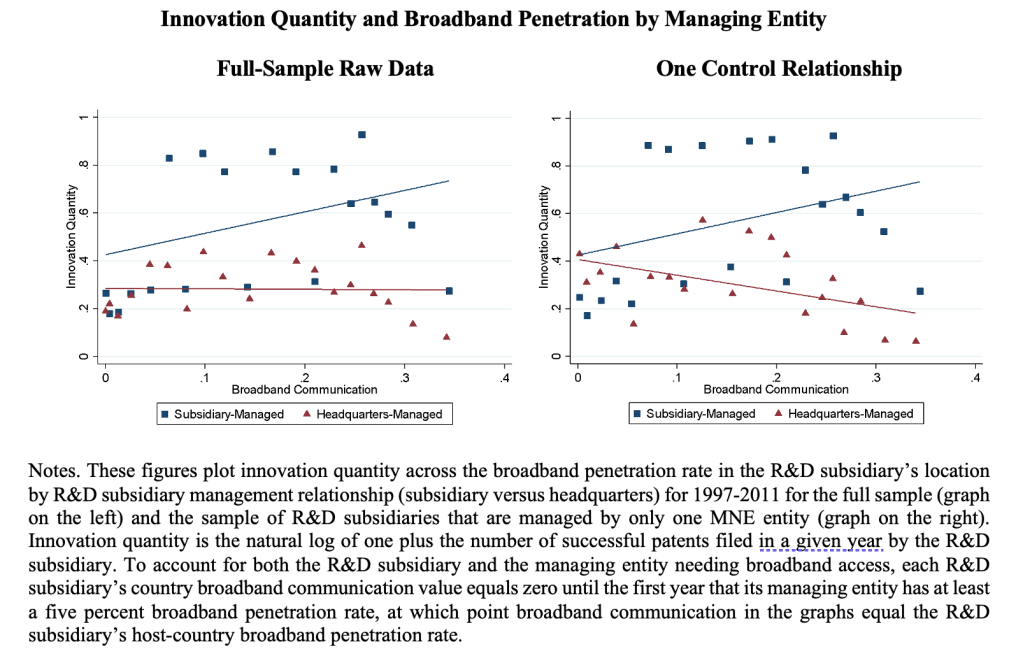

Improvements in connectivity infrastructure can stimulate innovation by reducing information frictions across locations, yet firms benefit unevenly, and the organizational sources of this heterogeneity remain insufficiently understood. Drawing on information processing theory, this study examines how the locus of managerial authority within multinational enterprises (MNEs)—specifically, whether R&D subsidiaries are managed by headquarters or by another subsidiary—influences the change in innovation from improved connectivity. We use a novel longitudinal dataset covering 1,004 R&D subsidiaries from 78 MNEs and exploit the staggered global rollout of broadband as a quasi-exogenous shock to connectivity. Triple difference analyses using matched samples indicate that broadband increases subsidiary innovation on average, but the effects are driven by R&D subsidiaries managed by other subsidiaries. These subsidiaries experience substantially larger post-broadband increases in innovation productivity, knowledge flows from, and co-inventions with their managing entity than headquarters-managed subsidiaries. Additional analyses indicate that the gap widens when headquarters face greater information complexity, associated with larger MNE size, more extensive international operations, and broader roles, suggesting that headquarters’ heavier information load constrains its ability to leverage improved connectivity. Consistent with information processing under constraints, we find suggestive evidence that headquarters prioritize their most important and technologically proximate subsidiaries. In contrast, subsidiary-managed units achieve innovation gains more broadly. Overall, the findings show that the innovation benefits of connectivity infrastructure hinge on organizational structure, highlighting the pivotal role of subsidiaries in managing innovation and the conditions that can impede or enhance these effects, advancing understanding of both connectivity-enabled innovation and MNE management.

Ballesteros, Luis. 2025. “Exploratory Innovation and Traumatic Shocks”. First submission. Available here.

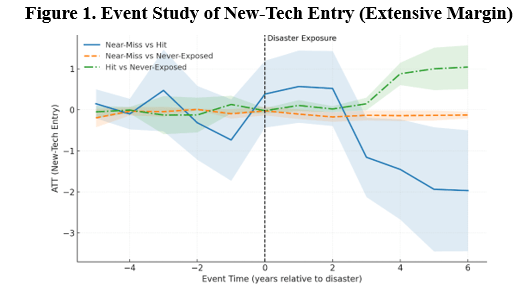

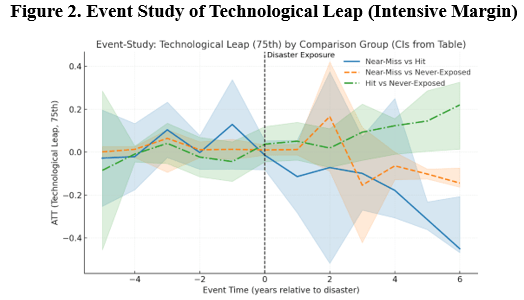

Unexpected traumatic shocks can alter inventors’ willingness to pursue risky, exploratory innovation. Leveraging spatially precise data on U.S. patents and natural disasters (floods, storms, earthquakes, and volcanic eruptions, 1995–2022), I contrast innovation dynamics between areas narrowly hit by disasters and near-miss locations. Contrary to intuition, disaster-hit grids significantly increase new technology entries by 40% and technological novelty by nearly 29% compared to near-miss grids. These effects strengthen over time, particularly after moderate-intensity shocks, whereas severe disasters impose binding resource constraints. Results highlight how serendipitous exposure to trauma recalibrates local innovation trajectories, underscoring nuanced relationships between risk and innovation capacity. Findings clarify mixed prior evidence and offer actionable insights for innovation policy post-disasters.

Ballesteros, Luis, Xia Li, and Leandro Nardi. 2025. “How Managerial Decisions in Response to Climate Disasters Shape Racial Pay Inequality”. First submission. Available here.

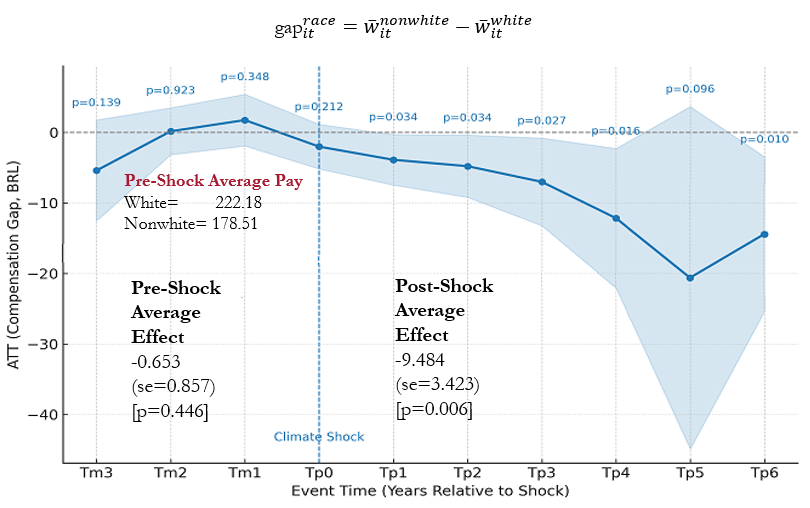

Climate-related disasters are an increasingly common feature of the business environment, yet little is known about how such shocks shape inequality within firms. Leveraging administrative panel data covering the universe of formal sector establishments in Brazil, we examine how local climate disasters affect the racial wage gap inside firms. Using an event-study design centered on the first exposure to a local disaster, we find that climate shocks trigger a persistent widening of the within-firm racial pay gap: white employees receive significant post-shock wage gains, while pay for nonwhite employees remains largely unchanged. These effects are not explained by selective attrition or workforce composition shifts—contract counts for both white and nonwhite employees decline in parallel after disasters. The widening is most pronounced in contexts of high local employer concentration (labor market power) and is evident across skill levels, while urbanization appears to moderate the effect. Our findings reveal that firm-level pay-setting decisions under crisis can amplify existing inequalities, positioning managerial agency and market structure as critical moderators of distributive outcomes under climate risk. This study advances literatures on organizational resilience, personnel economics, and the industrial organization of labor by illuminating a novel mechanism linking climate shocks to within-firm inequality.

Magelssen, Catherine, Casidhe Troyer, and Luis Ballesteros, and . 2025. “When do Communication Technologies Improve the Management of Innovation”. R&R at Organization Science. Available here .

Communication technologies (CTs) have long been viewed as important tools for managing innovation in geographically distant R&D subsidiaries. Yet whether CT-enabled reductions in communication costs between management and R&D subsidiaries actually improve innovation outcomes has remained theoretically and empirically unresolved due to two structural tensions. First, even the most advanced CTs are relatively limited in transmitting tacit knowledge, which is critical for key aspects of innovation management such as monitoring and knowledge-sharing. Second, CTs can enable tighter managerial control over the innovation process, potentially constraining the initiative and creativity that innovation requires. We theorize that whether adoption of a given CT improves R&D subsidiary innovation depends on organizational conditions that mitigate these potential constraints. We test the resulting contingency framework using a unique dataset linking R&D subsidiaries to their managing entities, and exploit the staggered rollout of broadband as an exogenous shock to communication costs. We find that broadband introduction increases R&D subsidiary innovation, but only when (1) the managing entity and R&D subsidiary co-invented prior to adoption, helping overcome the CT’s tacit knowledge limitations, or (2) managing entity’s span of control is high, limiting the likelihood of increased managerial intervention. Supplemental analyses support the proposed mechanisms. These findings show that CT adoption alone is insufficient to improve innovation. Instead, organizational context shapes whether firms realize the benefits—and minimize the negative consequences—of reduced communication frictions.

Ballesteros, Luis. 2025. “Geopolitical Tensions and the Financial Returns of MNE Foreign Disaster Aid”. First submission. Available here.

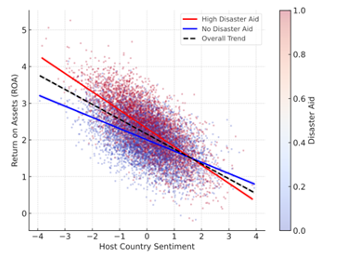

Geopolitical tensions heighten operational risks for multinational enterprises (MNEs) from negatively perceived home countries by fostering distrust in foreign markets. However, these tensions also present opportunities for these MNEs to enhance foreign-market performance through targeted non-market actions. Building on research on public opinion and international non-market strategy, this study theorizes that addressing the urgent and salient needs created by disasters, whose importance tends to garner consensus among a wide range of stakeholders, allows MNEs affected by home-host country tensions to demonstrate alignment with local welfare, transcend biases tied to their national identity, build trust, and, ultimately, improve market conditions in host countries. Instrumental variable analysis of the largest 1,981 MNEs from 64 home countries responding to 9,940 disruptions affecting 104 host countries from 1995 to 2022 indicates that foreign disaster philanthropy leads to economically important gains for MNEs from negatively perceived home countries, which are not replicated by firms from positively perceived countries and domestic philanthropy. While these effects are amplified by geopolitical shocks, the evidence does not strongly confirm that low governance quality plays a significant effect, suggesting that informal institutions, such as public sentiment, determine the returns of international philanthropy across varying institutional contexts.

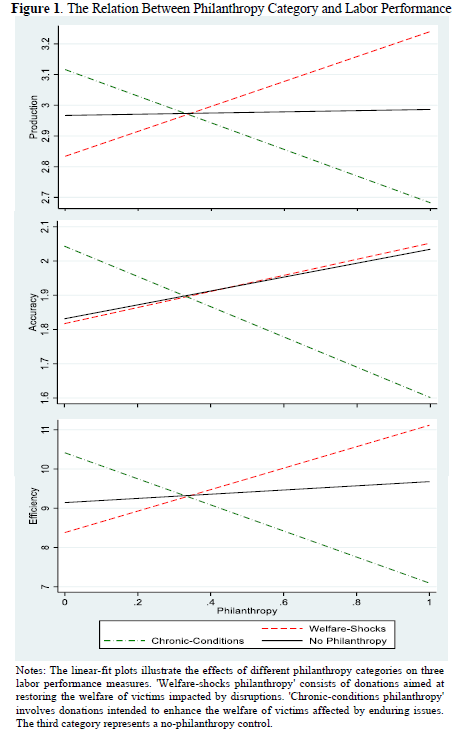

Ballesteros, Luis and Vontrese Pamphile. 2025. “The Dual Labor Effects of Corporate Philanthropy.” Second R&R at SMJ. Available at https://dx.doi.org/10.2139/ssrn.4684050.

This study explores the proposition that the specific social causes targeted by corporate philanthropy influence its effects on labor performance. We introduce a categorization based on social psychology, distinguishing between welfare-shocks philanthropy, aimed at providing welfare restitution for victims of disruptions, and chronic-conditions philanthropy, focused on welfare improvement for those facing longstanding problems. Our experimental evidence demonstrates that exposure to welfare-shocks philanthropy significantly enhances workers’ production, accuracy, and efficiency. In contrast, labor performance tends to decrease under chronic-conditions philanthropy and remains unchanged in the absence of philanthropy. These results broadly generalize in matched difference-in-difference estimates spanning 12 years of philanthropic activity by U.S. corporations. Our findings suggest that not all philanthropic efforts are equally motivating for employees and underscore the strategic importance of the philanthropic focus in influencing labor performance, both positively and negatively. Consequently, this study helps reconcile previous varying results regarding the strategic value of corporate philanthropy, offering a nuanced understanding of how this non-financial incentive can shape workforce dynamics and guide the design of more effective philanthropic strategies.

Ballesteros, Luis. 2025. “The Influence of MNE’s Local Reputation on the Financial Rents from Responding to Large Disasters”. First submission. Available at https://dx.doi.org/10.2139/ssrn.4721289.

I explore the financial implications of multinational enterprises’ (MNEs) philanthropic responses to international disasters. While MNEs have been the fastest-growing sector in disaster relief philanthropy, there is ambiguity surrounding the financial consequences of their donations. Using a firm’s country reputation as a theoretical lens, I posit that stakeholders are more influenced by a company’s pre-existing reputation than the actual donation amount when its social value is ambiguous. Employing a staggered difference-in-differences approach on data from 2005 to 2019, I find that initial donors with favorable country reputations experience unexpected gains compared to initial donors with an unfavorable reputation. Additionally, subsequent firms matching the donations of initial donors with good reputations also observed positive revenue effects. However, the impact is less clear for subsequent donors that diverged in donation amounts. The findings underscore the significance of MNE reputation in influencing stakeholder perceptions and consequent financial outcomes in disaster philanthropy. Furthermore, they challenge the prevailing notion that swift, large donations invariably lead to positive financial results, offering insights for more strategic philanthropic engagements in volatile contexts.

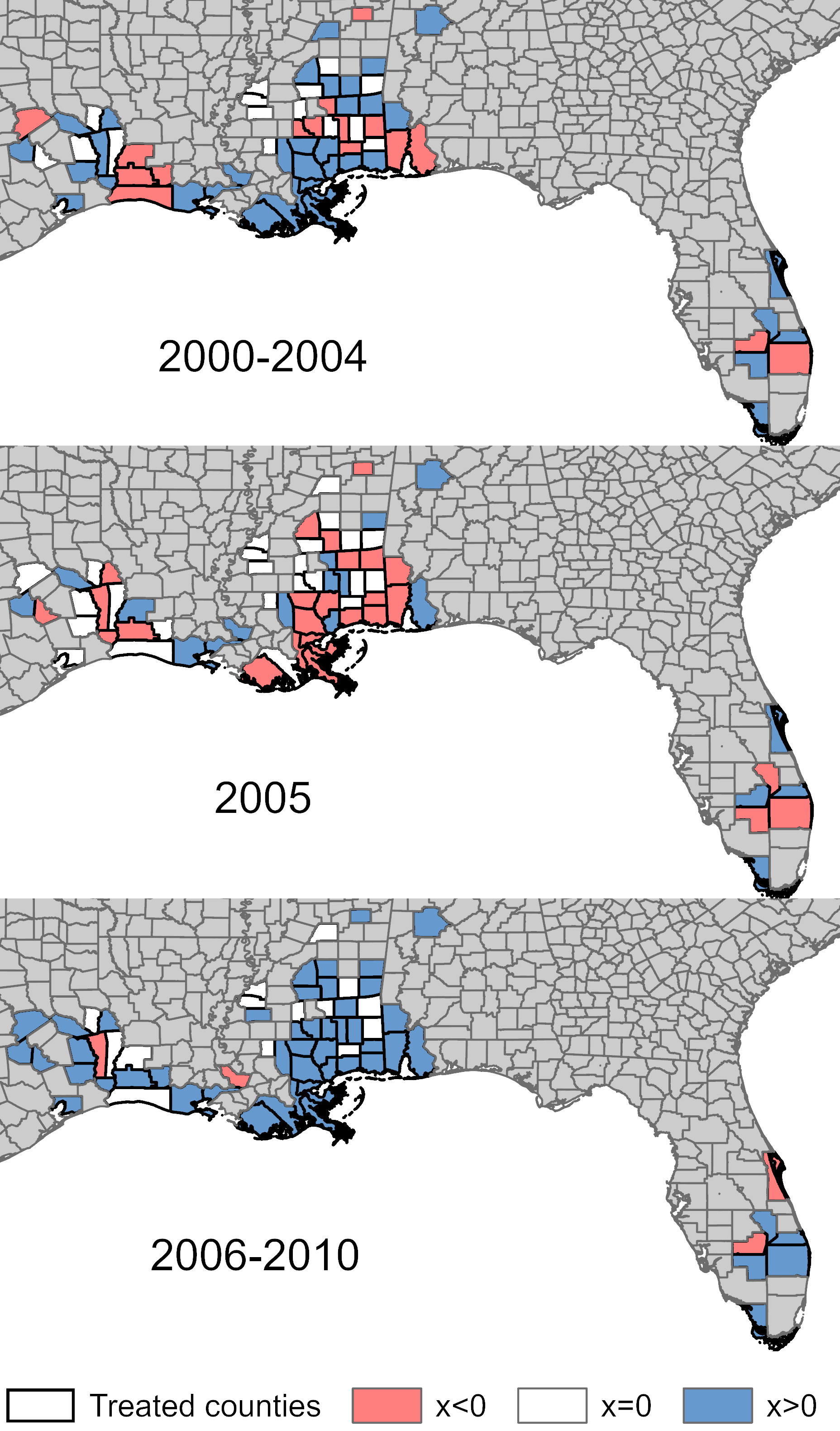

Ballesteros, Luis. 2024. “Innovation as a Response to Disruption: Explaining Patenting Increases Post-Hurricane Katrina”. First resubmission to Management Science. Available at https://dx.doi.org/10.2139/ssrn.3980107.

This study investigates how large exogenous shocks, such as natural disasters, can lead to sustained changes in economic behavior, focusing on the impact of Hurricane Katrina on innovation. The analysis reveals that counties affected by Katrina experienced notable increases in both the quantity and quality of patenting activities compared to similar unaffected counties. These increases, measured through matched-sample difference-in-differences estimates, correlate with the severity of the damage and persist for up to a decade. The increases remain significant even when accounting for factors such as economic recovery post-disaster, shifts in innovation demand, levels of aid and investment, wealth, education, and traditional drivers of innovation like firm R&D, institutional support, and market dynamics. However, these increases are more pronounced in areas with higher inventor density and collaboration. By constructing georeferenced inventor histories, I control for variables like selective migration and company affiliations. The findings uncover an environmental driver of innovation that has been largely overlooked, highlighting how responses to significant large shocks can affect inventive activity.

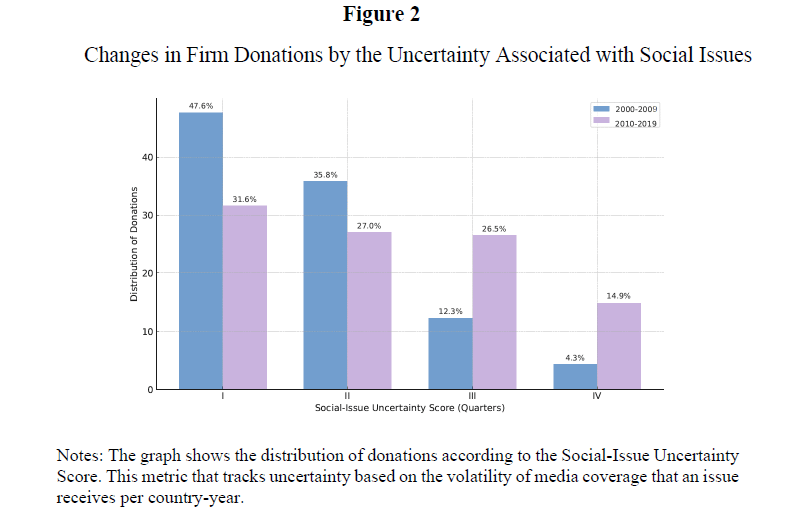

Ballesteros, Luis and Tyler Wry. 2023. “How the Uncertainty Associated with Social Issues Influences the Returns of Corporate Prosocial Behavior”. Under revision. Available at https://dx.doi.org/10.2139/ssrn.4721269.

This study examines whether the varying financial returns to philanthropy can be explained by the uncertainty associated with the issues to which a firm donates. We start with the premise that stakeholders react favorably to donations they view as effective and appropriate for specific social needs, which can lead to financial advantages for the donor firm. However, the reliance on various cues for such assessments may differ based on the uncertainty surrounding social issues. For stable issues, where the social need and redress strategies are relatively clear and direct, we expect that proximate cues such as the donation amount and a firm’s donation experience are likely indicators of philanthropic effectiveness, thereby predicting its financial returns. Conversely, when donations target uncertain issues where the social need is unclear or evolving, these cues become less informative, prompting stakeholders to consider broader cues, such as firm reputation. Our analysis introduces a method for measuring the country- and time-specific uncertainty of issues and applies it to evaluate donations from the world’s largest 2,000 firms from 2007 to 2018. The policy and managerial relevance of our study is underscored by the increasing engagement of firms in social issues fraught with high uncertainty.

Ballesteros, Luis and Catherine Magelssen. 2022. “Institutional disruptions and the philanthropy of multinational enterprises” Organization Science https://doi.org/10.1287/orsc.2021.1491. Appendix.

This paper studies philanthropy by multinational enterprises (MNEs) during institutional disruptions—the sudden and unexpected, temporary, and systemic breakdowns in economic institutions. The central argument is that, under institutional disruptions, MNEs aim to restore factors that are essential for the market to function, such as infrastructure and labor markets, and the strength of this motive rises in the economic importance of the affected country to the MNE. Analyses of donations from 2,000 MNEs headquartered in 63 countries in the aftermath of 265 major epidemics, natural disasters, and terrorist attacks affecting 129 countries suggest that the economic importance of the country to the firm strongly explains donations. Market concentration, public aid, and the country’s regulatory quality moderated this effect. These associations are robust to a matching method, a vector of firm-, country-, and event-specific time-varying and -constant variables, and alternative motives such as reputation, altruism, media salience, market standing, and poverty-gap avoidance. They offer evidence that company philanthropy in the aftermath of institutional disruptions may deviate from predicted behavior under stable conditions. Particularly, the findings contest the expectation that philanthropy rises in market competition. We find that monopolistic firms are comparatively large donors and may act as a stop-loss mechanism during large disruptions.

Produced dataset publicly available: Global Subsidiary Footprint Index. It captures the country share of firm operations. 129 countries X 2,000 firms (largest firms by revenue at the international level). Available here.

Media and recognition:

-CGTN America: Corporate Giving to Disasters.

-The Conference Board: When Company Tackle Great Challenges. -The Conference Board: When Company Tackle Great Challenges.

-The European Business Review: Disruption Strikes, You’re in Charge.

-Knowledge@Wharton: COVID-19 Disaster: Why Firms Should Lead the Recovery.

-Best PhD Paper, Strategy Management Society Annual Meeting 2015.

Ballesteros, Luis and Howard Kunreuther. 2021. Organizational Decision Making Under Uncertainty Shocks. No. w24924. National Bureau of Economic Research. Third revision.

In line with the fallacy of riskification of uncertainty by which decision makers believe that the effects of unpredictable phenomena can be captured accurately by probability distributions, organizational scholars commonly treat the organizational inefficiency in dealing with uncertainty shocks—exogenous hazards whose welfare effects spread across industries and markets, such as natural disasters, terrorist attacks, and financial crises—as a problem of risk management. This is problematic because the consequences of uncertainty shocks outstrip the predictability capacity for the average manager and entail a greater complexity of internal and external factors. Moreover, their uniqueness makes translating experience into learning far more difficult. We seek to address this inadequate approach with a theoretical framework that captures the multidimensional complexity of organizations preparing for, coping with, and recovering from exogenous uncertain disruption. We bring together the literatures on cognitive psychology that suggest that biases and heuristics drive behavior under uncertainty, a Neo-Carnegie perspective that indicates that organizational structure and strategy regulate these behavioral factors, and institutional theory that points to stakeholder and institutional dynamics affecting economic incentives to invest in prevention and business continuity. Taken together, this article offers the foundation for a behaviorally plausible, decision-centered perspective on organizational decision-making under uncertainty.

Ballesteros, Luis and Aline Gatignon. 2019. “The relative value of firm and nonprofit experience: Tackling large-scale social issues across institutional contexts ” Strategic Management Journal 40.4 (2019): 631-657.

Nonprofit organizations (NPOs) are often identified as a natural vehicle for the engagement of firms in large‐scale social issues. We evaluate this argument by examining the conditions under which NPO experience is more valuable than firm experience in overcoming the key challenges associated with corporate disaster giving. Findings from a quasi‐experiment across the 4,396 natural disasters worldwide between 2003 and 2015 demonstrate that firms could donate more by implementing the aid through NPOs (on their own) in countries with low (high) institutional development, especially where they lack (have) market operations. However, we also observe that firms more frequently than not opted into the allocation mode that yielded comparatively low aid, raising questions about incentive alignment and communication across the business and nonprofit sectors.

Media and recognition:

-The Washington Post: It’s bad business not to donate to Nepal.

Ballesteros, Luis, Michael Useem, and Tyler Wry. 2017. “Masters of disasters? An empirical analysis of how societies benefit from corporate aid.” Academy of Management Journal 60.5 (2017): 1682-1708.

Corporations have become increasingly influential within societies around the world, while the relative capacity of national governments to meet large social needs has waned. Consequentially, firms are being asked to adopt responsibilities that have traditionally fallen to governments, aid agencies, and other types of organizations. There are questions, though, about whether this is beneficial for society. We study this in the context of disaster relief and recovery; an area where companies account for a growing share of aid as compared to traditional providers. Drawing on the dynamic capabilities literature, we argue that firms are better-equipped than other types of organizations to sense areas of need following a disaster, seize response opportunities, and reconfigure resources for fast, effective relief efforts. As such, we predict that—while traditional aid providers are important for disaster recovery—relief will arrive faster, and nations will recover more fully when locally active firms account for a larger share of disaster aid. We test our predictions with a proprietary database comprising information on every natural disaster and reported aid donation worldwide from 2003 to 2013. Our analysis uses a novel, quasi-experimental technique known as the synthetic control method and shows that nations benefit greatly from corporate involvement when disaster strikes.

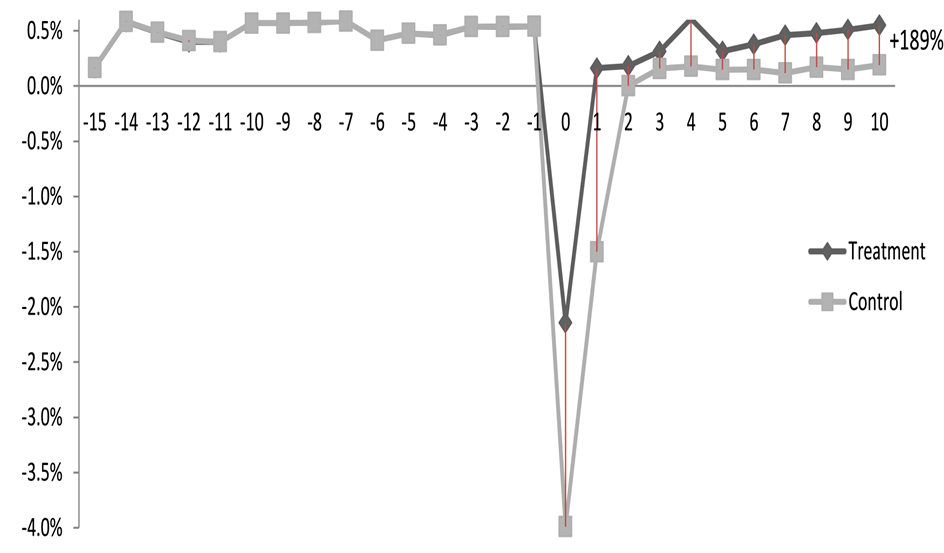

The Effect of Giving from Locally Active Firms on Post-Disaster Recovery (15 years pre-disaster; 10 years post-disaster)

Media and recognition:

-Responsible Research in Management Award 2019, IACMR-RRBM.

-Harvard Business Review: Giving After Disasters

-Strategy+Business: Corporate First Responders, Strategy+Business

-Knowledge@Wharton: Mastering Disaster: How Companies Can Help in Rescue and Recovery

–UNOCHA & DHL: “Leveraging Formal and Informal Business Partnerships for Disaster Relief”, How Public Private Partnerships are Making a Difference in Humanitarian Action